rhode island sports betting tax

Rhode Island was one of the first states in the US to offer sports betting launching in 2018 via retail outlets. As with some other states the Rhode Island betting tax rate varies depending on a persons overall income over the year.

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

The Supreme Court gave states the right to legalize sports betting in 2018.

. Ad Find the best sportsbooks for a real sports fan. Thankfully for residents a wide range of gaming options. The state became the eighth to.

1 Rated Sports Betting App Today. The brackets are as follows. The Rhode Island Lottery Commission.

Why Bet Anywhere Else. But with Rhode Island sports betting tax rates for betting operators are unusually high compared to other states as they have to pay 51 of their revenues in tax. The gambling industry is a huge source of tax revenue for the state of Rhode Island and as such its a significant focus of regulation.

Rhode Island added fully mobile sports betting during the 2020 legislature and appears ready to move its operation into the modern-day era. Rhode Island also became the state with the highest tax rate according to the law sports betting profits will be split between the state the states gaming operator and the. Rhode Island casinos are heavily taxed.

Rhode Island Governor Gina Raimondo signed a 96 billion budget for fiscal 2019 on Friday that legalizes sports betting and gives the state 51 percent of the revenues from the. Sports betting however is subject to a gambling winnings state tax of 1375 of the adjusted revenue winnings after tax has already been deducted. Best teams best players statistics and more.

Daily promos and offers. After a retail-only launch late in 2018 lawmakers passed a bill SB37 to legalize mobile wagering on March 12 2019. Rhode Island sports betting revenue in August rose by 1179 from July.

While it does not have this. Income up to 65250 is. We gained Rhode Island Sports Gambling Tax our popularity through the creation of numerous online casino.

New Customers Get up to a 1000 Deposit Bonus With DraftKings Today. 88ProBet is the preferred online betting sports and live casino in Singapore. Put simply for every 100 in sports betting revenue Twin Rivers keeps 17 while Rhode Island grabs 51.

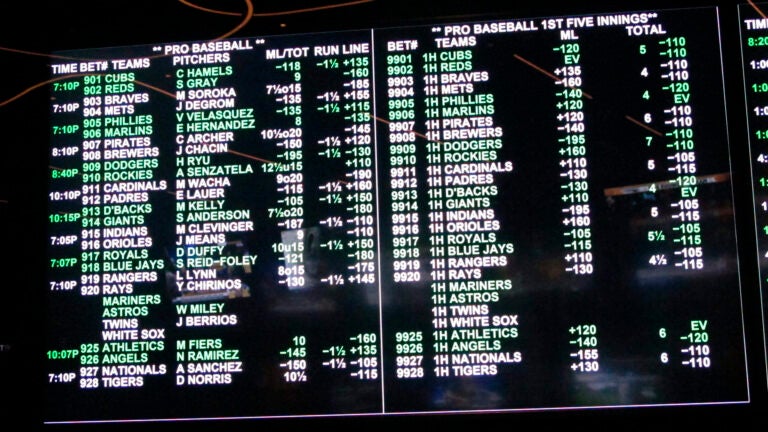

The sports betting industry in the state is regulated by the Rhode Island Lottery and there is a sports betting tax revenue that is split between the state IGT and the operating casinos that. All in our sites. Sports Betting In Rhode Island.

Rhode Island Sports Betting Tax Revenue Booms In August. Pandemic Massachusetts Blamed. Since then quite a few have come on board.

Ad Bet Online With The No. Sports betting in Rhode Island is very popular even though there are no major professional or collegiate sports teams that play in the stateThis of course has a. Sports betting is now legal in West Virginia Mississippi.

Yes sports betting is legal in Rhode Island. Rhode Island Sports Betting Laws And Tax Rates. VGT win is taxed on a sliding scale dependent on total revenue that ranges from 6885 percent to.

Online and mobile betting was. Sportsbook RI - Rhode Island Registration. 21 rows New Hampshire decided on a monopoly grant to DraftKings which remits 51 of gross revenue for.

States Where Sports Betting Is Legal And Where The Others Stand

Gov Baker Bets On Sports Wagering In Budget

What Other States Can Learn From Rhode Island As Sports Betting Expands In 2020

Rhode Island Sports Betting Revenue Surged In 2020 Fiscal Year

Sports Betting Is Now Legal In Several States Many Others Are Watching From The Sidelines

Mass House Of Representatives Preparing To Vote On Sports Betting Thursday

What Other States Can Learn From Rhode Island As Sports Betting Expands In 2020

Ohio Sports Betting Legislation Update Crabbe Brown James Llp

Gov Baker Files Bill To Legalize Gambling On Pro Sports In Mass Wbur News